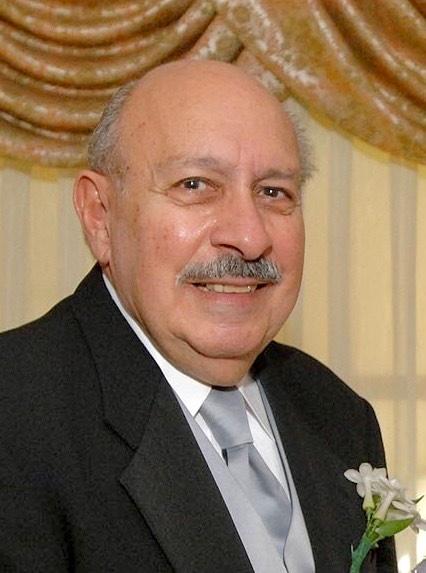

Jeremy Grantham: The Super Bub

Jeremy Grantham (Trades, Portfolio) is a billionaire investor and the founder of GMO LLC, an investment firm that reported ~$19 billion in 13F holdings as of the end of the first quarter of 2023.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Grantham is well known for his apocalyptic predictions of “Super Bubbles” and subsequent market crashes. In an April 2023 interview on the “We Study Billionaires” podcast, Grantham gave his thoughts on the banking crisis, and if this could be a catalyst for the “Super Bubble” to pop finally. Here are my notes on the interview.

What is a ‘Super Bubble?’

Grantham states a “bubble” is a two-and-a-half standard deviation event that occurs approximately every 10 to 15 years. These are “easy to spot” and the market data stands out like a “Himalayan peak.” For example, in the dot-com bubble, the S&P 500 reached close to 45 times earnings. A “Super Bubble” is an even more extreme event that impacts multiple asset types and is a “three sigma” event, meaning it is likely to occur once in one hundred years.

Record-high debt is a recipe for disaster

Grantham believes that the Federal Reserve is tightening its interest rate policy “until something pop.” Given the U.S. debt level is at a record high of $32 trillion and the cost of servicing the debt costs $384 billion, or 12% of GDP, this is a dangerous time. Grantham points out that in previous bubbles such as in 1929, the Japanese stock bubble in 1989 and the dot-com bubble in 2000, debt levels have also been egregiously high relative to GDP. This is because during the “good times,” it has been human nature to pile on excess debt in order to amplify a roaring economy. However, as

Warren Buffett (Trades, Portfolio) would say, “When the tide goes out you see who’s been swimming naked,” referring to what happens to those that have taken excess risk.

Banking crisis as a catalyst

The Silicon Valley Bank crisis sparked many fears among investors, and it even caused a bank run by customers of many mid-tier banks. Grantham compares a “Super Bubble” popping to a dam bursting – you will never be able to predict which brick goes first. In fact, you should “expect the unexpected,” as this is the “nature of the beast.” An example is Bear Sterns, which went from having a $20 billion market cap in 2007, to close to bankruptcy by 2008, before JPMorgan (JPM, Financial) acquired the firm for a measly $2 per share.

How far could the stock market fall?

The S&P 500 is only down ~12% from its high in December 2021. Therefore, Grantham believes there is a long way down to go from the “peak of optimism” to at least “mild or severe panic.” History doesn’t always repeat but it does tend to rhyme.

If we assume the “pop” of the current bubble was Jan. 1, 2022, we are now ~455 days into the decline (as of April 2023). Compared to historic crashes, 2000, 2007, 1968 and 1973 also took a similarly long period of time before the real crash occurred.

Another characteristic of a “Super Bubble” is a bear market rally, after an initial “de-rating” stage.

Grantham also points out that market crashes should be adjusted for inflation. For example, the U.S. reported a peak inflation rate of 9.1% on the CPI, which then fell to 4% as of May 2023. However, in the years 2007 and 2008, inflation hovered around the 5% figure. Thus, Grantham believes the market is really down between 17% and 23% in real terms, as real returns are lower.

Will we have a recession?

According to a survey of economists from both industry associations and academia that Grantham referred to but did not specify, 58% of those professionals believe a recession is likely to occur in late 2023. Grantham points out that after the pop of bubbles in the past, there has been a recession. The severity of the recession is generally governed by how well the Fed handles the process. For example, the recession post the dot-com bubble was “relatively mild.” However, in 1929, it was handled very badly, and that caused the Great Depression.

Post-2008, many banks and institutions battled against what they called “excess regulation” as they believed fears were unjustified just because of one sub-prime mortgage crisis. For example, in 2015, Greg Becker, the president of Silicon Valley Bank, submitted a statement to a Senate panel urging legislators to exempt his bank from new regulations. This corporate “weaseling” as Grantham likes to call it can often have disastrous consequences, as we are seeing now.

There is a “commercial imperative” to be bullish, and Grantham believes this is embedded into the investment commentary of the majority of established banks and analyst firms, as it’s good for their own business.

In addition, central bank representatives over the past few decades have forecasted a “soft landing,” but according to Grantham, we have never had a soft landing.

Buybacks could be bad for the economy

An interesting trend Grantham highlighted is the reduction in capital expenditures for businesses, which are instead buying back stock and not paying dividends. This may seem good for shareholders in the short term as it reduces the share count and increases the stock price, but it ultimately creates fewer jobs and doesn’t improve GDP, as an individual’s wage is someone else’s income. Also, no tax is paid on the buyback, but it would be paid on the dividend, which boosts government funds to invest in services.

Dangers of capitalism

Capitalism is an incredible economic system that promotes private ownership and trade. This helps to facilitate supply and demand balances, as it focuses on profit maximization. However, an issue with capitalism is it is not designed for “altruism,” and mammoth organizations can pool huge funds and market positions.

In a study from The Economist in 1990, smaller companies below a $1 billion market capitalization made an 8% return on sales. However, the larger companies at over $10 billion market capitalization made a 12% return on sales. Grantham believes this made sense as due to economies of scale, the larger companies made 50% more than the little guys. But this gap has now widened substantially, and by 2021, the smaller companies now make just a 4% return and the larger companies made an 18% return.

Grantham believes this is a signal of an unhealthy system which is being run for the benefit of large corporations. Specifically, Grantham references the FAANG stocks which include Meta (META, Financial) (formerly Facebook), Apple (APPL), Netflix (NFLX, Financial) and Alphabet (GOOG, Financial)(GOOGL, Financial).

Apple and Microsoft (MSFT, Financial) have grown to have enormous market capitalizations of over $2 trillion each, making up ~15% of the S&P 500. We haven’t seen two stocks make up a similar proportion since IBM (IBM, Financial) and AT&T (T, Financial) back in 1978. Grantham believes both of these companies are “virtual monopolies.”

Resource and worker shortages

Two other potentially disastrous areas are “resource shortage” and “people shortage.” Resources include food supply, clean water, minerals, etc. Grantham expects cyclical resource shortages, which is inflationary.

People shortage refers to the fact that the global number of babies born will be the same as in the year 2000. In order to maintain a stable population, a fertility rate of 2.1 babies born per woman is required, of which it has maintained a similar level over the past four decades. However, in the U.S. this level is now just 1.7, and in the U.K. is 1.65. This means a population collapse is pending in these countries, with a worker shortage expected. There’s really no good solution to this as more people would worsen the resource shortage.

What is the best strategy?

Grantham believes the best strategy is to focus on the “realities” which are profits and revenue growth. He is more bullish on Japan and places such as the U.K. for cheaper stocks to buy than the U.S. Buffett has also recently announced he has increased his stake in Japanese stocks, which I have covered in a prior article.

Grantham also has half of his foundation fund with 65 to 70 investments in early-stage “green venture” investments, in order to help prevent climate change. He believes this is not just about altruism; the declining cost curve for electric vehicle batteries and solar panels will surge adoption as it makes economic sense.

Final thoughts

Jeremy Grantham (Trades, Portfolio) is an incredibly wise individual who is a contrarian by nature and not afraid of making bold and “doomsday” style forecasts. However, Grantham is still investing and has a vast investment portfolio. Each of these global issues are areas where human ingenuity and investment can help to solve problems.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/2T6XXA2PD5GAHLNYKPVR4UMI2A.jpg)