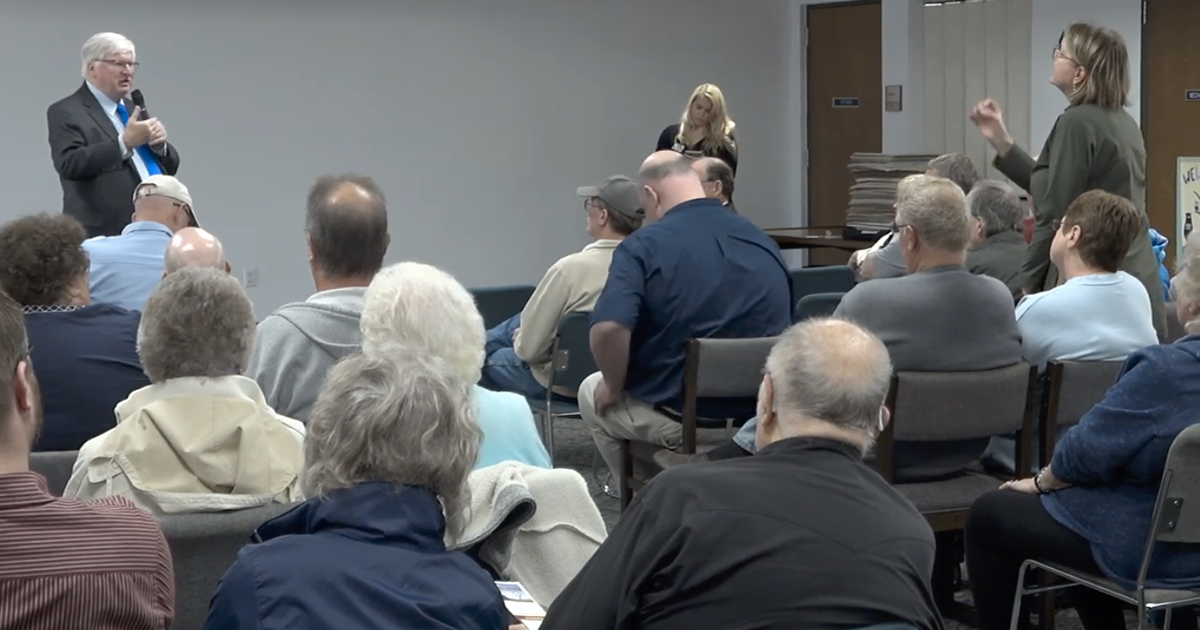

Rep. Glenn Grothman talks to his constituent, Barb, during a recent town hall session in Waupun.

Foremost in many people’s minds these days is the debt limit, an “inside-the-beltway” issue that has ramifications for Ripon-area residents’ pocketbooks.

Specifically, folks are starting to worry that Congress and the White House may not be able to agree to raise the amount of money the U.S. Treasury may pay on debt it already has amassed by borrowing more money.

Many economists agree that a failure to have a meeting of minds on both ends of Pennsylvania Avenue risks a default, which would downgrade America’s credit rating, spook the markets, sink stock prices and take a toll on people’s retirement savings.

Still, brinkmanship persists as a June 1 deadline — the earliest date by which the federal government may no longer fully meet its obligations — is only two weeks away.

Democrats want a clean bill passed that simply raises the debt limit on expenses already incurred, as has occurred many times in the past with presidents from both parties.

Republicans insist that a raising of the debt ceiling be accompanied by spending cuts so that America will start to right a fiscal position that now finds it an obscene $31.7 trillion in debt.

Ripon’s congressman, Rep. Glenn Grothman, R-Glenbeulah, is in the latter camp.

During a May 3 town hall meeting in Waupun, Grothman was questioned by “Barb” (no last name given).

Here is the exchange:

Barb: Isn’t the debt ceiling something that [addresses what] we’ve already incurred]?

Rep. Grothman: Well no, we can do, like I said, going forward, ah

Barb: And then during the budget time, that’s when you negotiate.

Rep. Grothman: We want to do it then, too. I mean It just seems irresponsible when you have all this record levels of debt and we’re headed towards a record that we didn’t even get after World War II

Barb: Right, but isn’t this affecting the stock market and stuff right now? People are getting nervous. Just do something right now. We’re getting scared.

Rep. Grothman: Well I guess either side could do something.

Barb: How about working together?

Rep. Grothman: We do not expect President Biden to do everything

Barb: How does Congress do? What does Congress do?

Rep. Grothman: Well Congress last week passed a proposal and one of the reasons President Biden said he wouldn’t negotiate was he didn’t think Republicans would ever be able to get their act together and have over half the House vote for a proposal. We did that last week which is why I assume yesterday Mr. Biden said now he is going to meet with the four leaders in Congress. I hope he does it. I hope he’s sincere. I’m not a Polyanna on this thing. You know to be honest with you, if the Republicans got 10 or 15% of what they’re asking for I would consider that a victory. Because you’re right, at the end of the day, we can’t allow America to default. But um

Barb: Why did this pass three times under Trump but not with Biden?

Rep. Grothman: Well I don’t know that we were anywhere near the crisis that we’re near right now.

Barb: Yeah we were (several audience members’ heads are nodding).

Rep. Grothman: We’re at 100% right now, like I said, almost 100% of GDP right now. A few years ago? 75ish, I don’t have the numbers, We have a debt increase of

Barb: Why? Is it because of tax cuts on the rich?

Rep. Grothman: No.

Barb: No? Are you sure?

Rep. Grothman: It is because of a huge increase in spending both under Covid and more recently

Barb: So what would you cut then?

Rep. Grothman: Well, I’ll try to [limit you] to one question. We are just trying to return to the level of spending that it was a year ago. We are not including any specific areas. I mentioned we are highlighting the transfer payments and that people are not having to work for. I think other agencies, though, have to make significant cuts. You seem like somebody who is up to speed on what is going on.

Barb: Well I have two sons who are in the military and they’re terrified they are not going to get paid.

Rep. Grothman: I wouldn’t worry about that.

Barb: OK. Thank you.

Rep. Grothman: We’ve always — don’t worry about that.

* * *

Grothman argued above that Republicans are justified to tie raising the debt ceiling to expenditure cuts because the debt-to-GDP ratio is “at 100% right now.”

Actually, it’s likely much higher. At the end of last year, it was 120%. Previously, it was at 121% (2021) and 127% (2020). It reached the 100% mark in 2012.

Grothman likely is using lower percentages because he doesn’t include Treasury bonds held by U.S. government agencies, primarily the Federal Reserve and Social Security Administration.

But more important, which party is taking the more responsible position regarding raising the debt ceiling?

Democrats. Once the bills are incurred, the debtor is responsible for paying the creditor. That’s conservatism 101: Pay your bills. don’t be a deadbeat and skip town when the bill collector comes a knocking.

And…

Republicans. It’s decades past time for Congress to begin spending within its means. There being no political motivation to do so (no one gets reelected by telling special interests “no”), congressional leaders and the president need to establish a procedure or commission, now, aimed at making hard choices so that entitlements remain solvent, a bloated Department of Defense is pared down and discretionary funding is curbed.

A debt-ceiling crisis is no time to identify cuts, as posturing GOP leaders have asked. That’s a political non-starter, and they know it. Nor is it time to keep writing checks on “investments,” as Democrats like to call spending.

It’s time to pay bills, now, and then make hard choices about a process to cut and then control spending so we don’t have to endure debt-ceiling brinkmanship so frequently.

— Tim Lyke